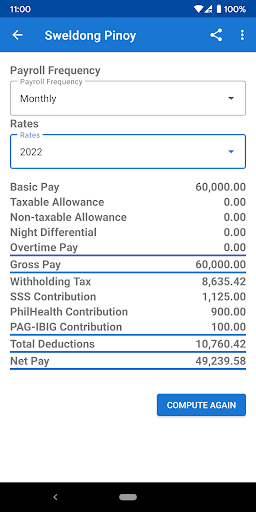

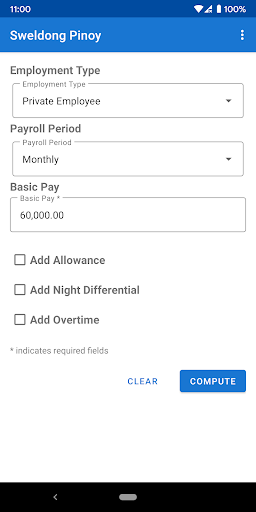

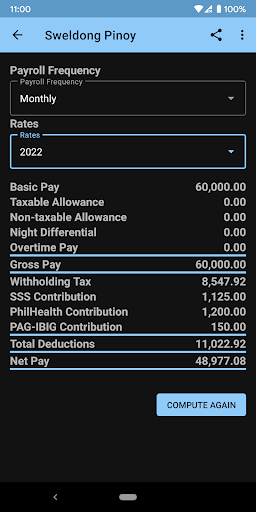

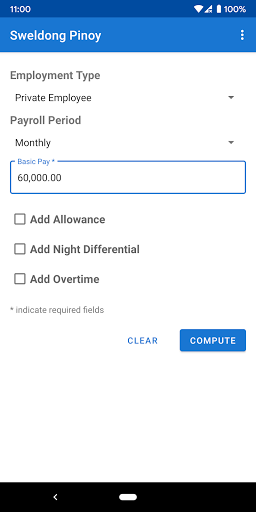

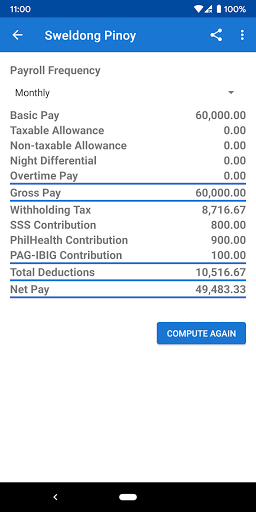

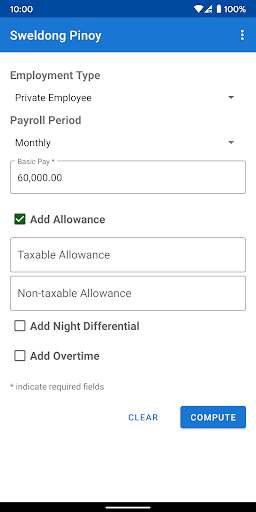

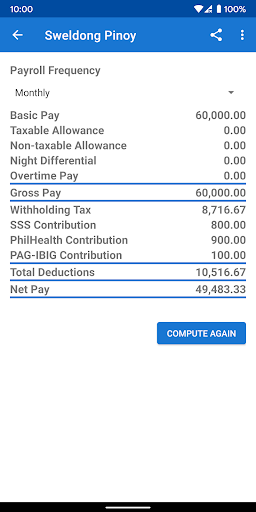

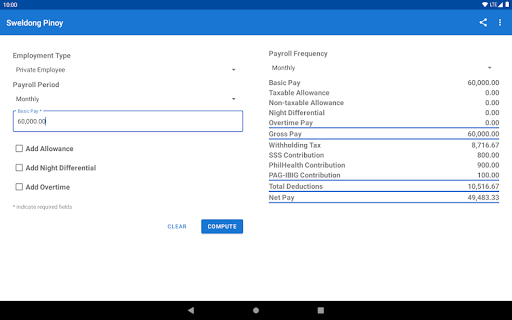

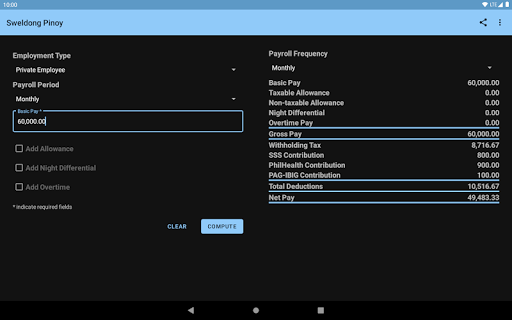

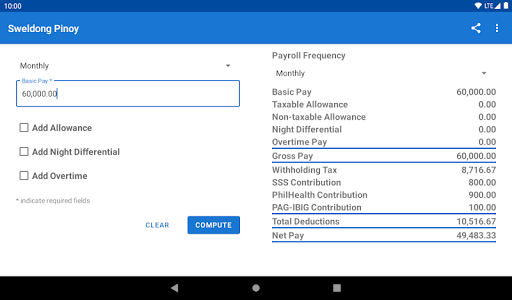

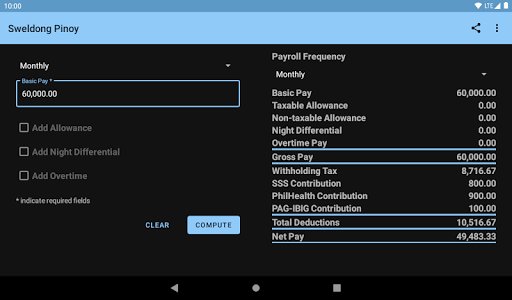

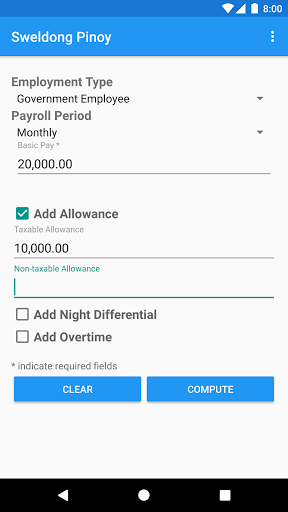

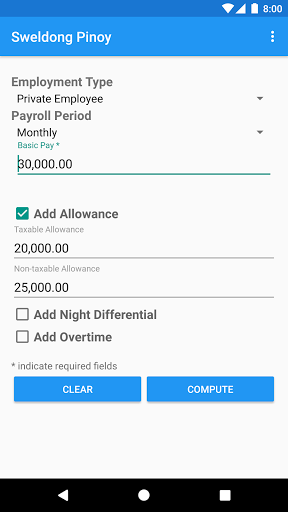

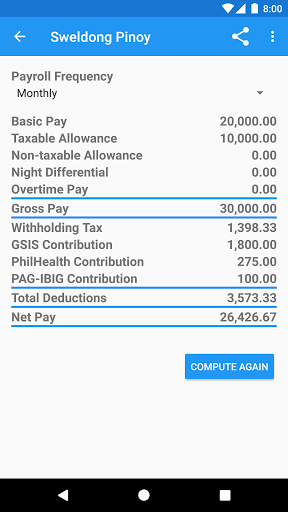

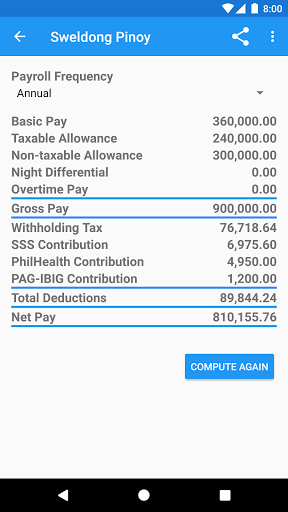

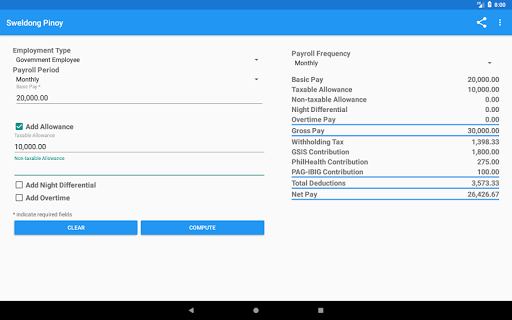

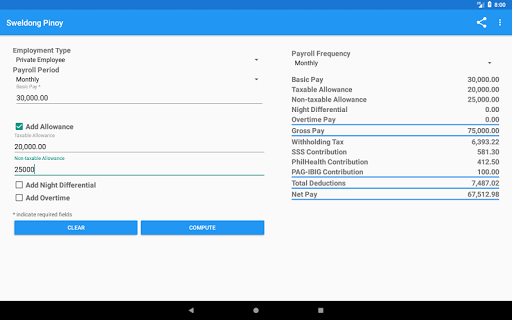

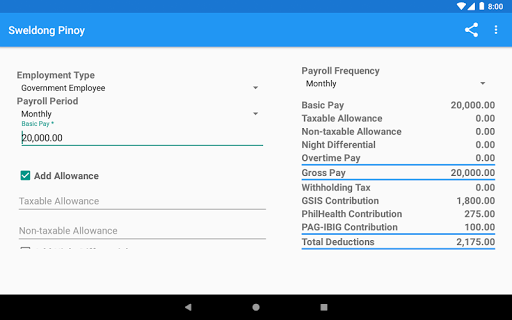

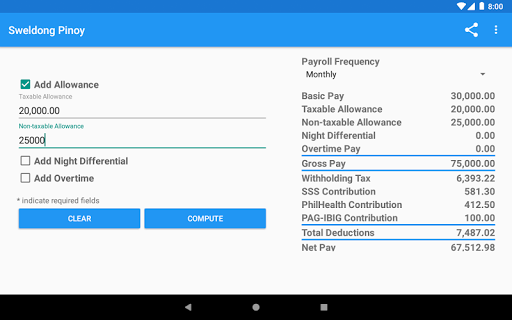

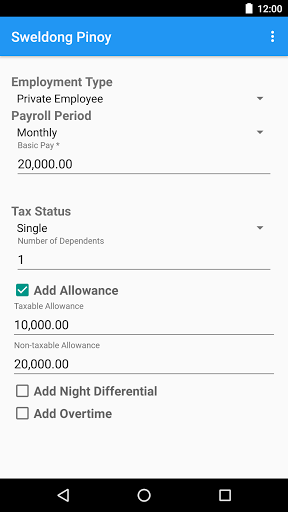

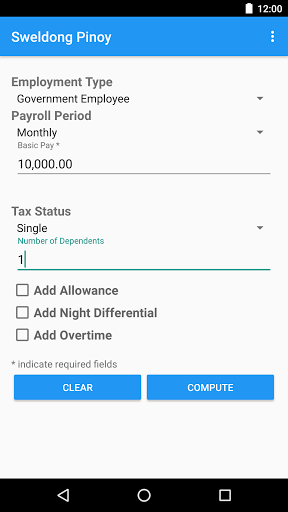

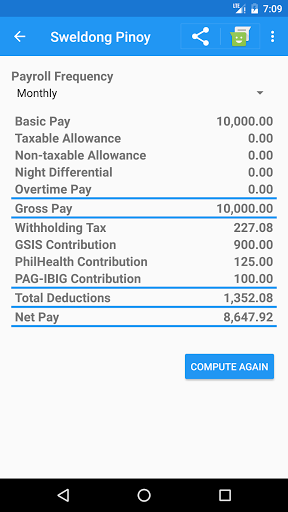

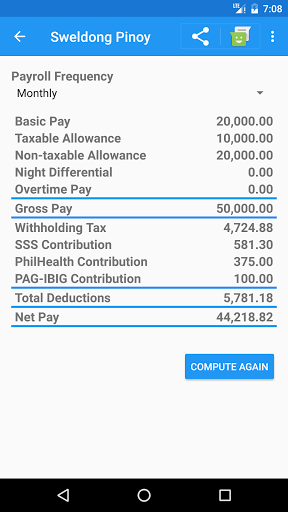

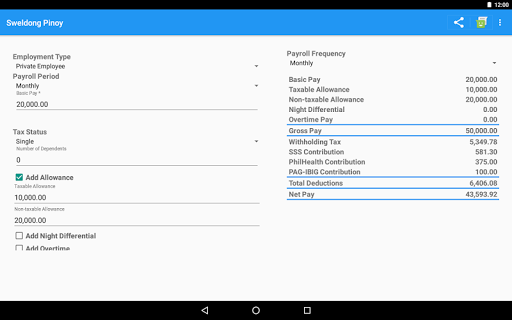

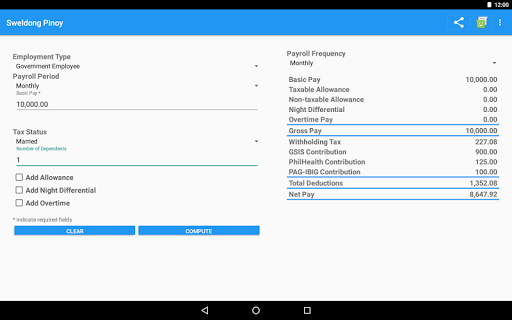

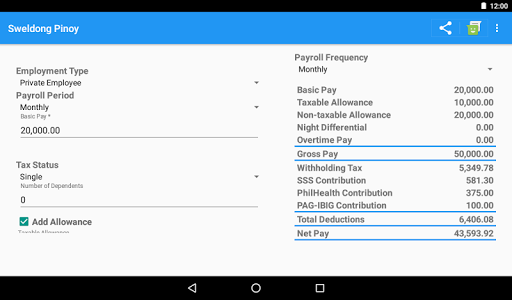

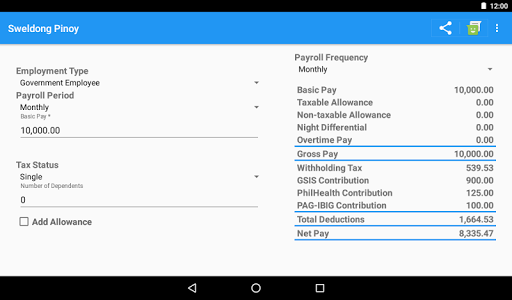

Sweldong Pinoy is a salary calculator for Filipinos to help them in computing gross and net pays, withholding taxes, and contributions to SSS/GSIS, Philhealth and PAG-IBIG.

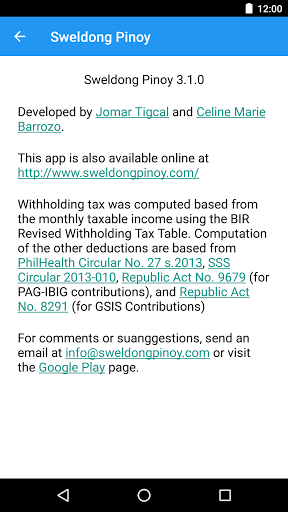

Computations of the deductions are based from Republic Act 10963 or TRAIN (Tax Reform for Acceleration and Inclusion), Republic Act No. 11223 (Universal Health Care Act)/ PhilHealth Circular 2019-009 (https://www.philhealth.gov.ph/circulars/2019/circ2019-0009.pdf), Republic Act No. 11199 (The Social Security Act of 2018), Republic Act No. 9679 (http://www.pagibigfund.gov.ph/home_pdf/HDMF%20Law%20'09.pdf) for the PAG-IBIG contributions, and Republic Act No. 8291 (http://www.gsis.gov.ph/about-us/gsis-laws/republic-act-no-8291/) for GSIS Contributions.

Install and try the app and help us improve it by giving feedback and suggestions.

Note: Internet connection is not required to use the app. You will only need it when you share the results online.

Sweldong Pinoy for 2025: Updating contributions for SSS

Adding Domestic Worker (Kasambahay) in the employment type and calculation

Design and performance improvements

Sweldong Pinoy for 2024: Updating contributions for 2024

Design and performance improvements

Sweldong Pinoy for 2024: Updating contributions for 2024

Design and performance improvements

Updating contributions for 2022

Sweldong Pinoy for 2022: Updating contributions for 2022

4.3

Sweldong Pinoy for Self-Employed Individuals

Design and performance improvements

4.2

Updating PhilHealth contributions based on RA 11223 (Universal Health Care Act)/ PhilHealth Circular 2019-009

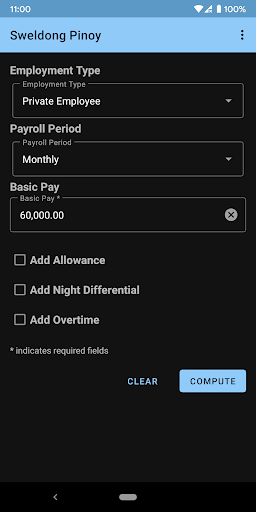

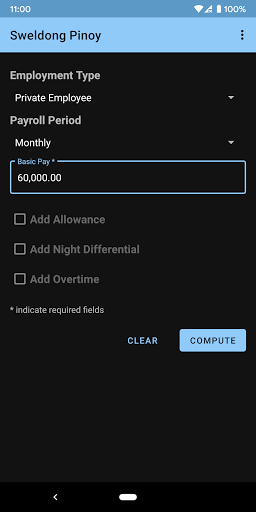

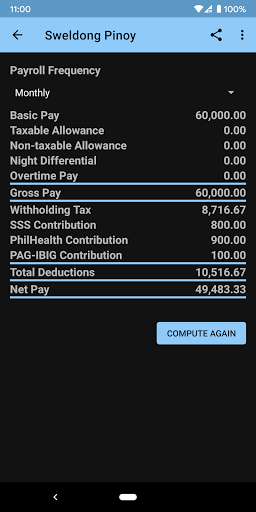

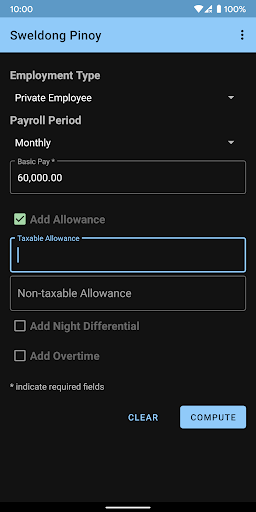

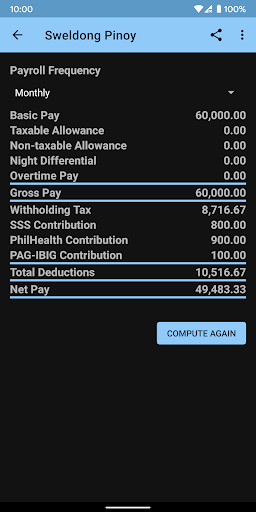

Redesign and adding of Dark Theme

4.1

Updating SSS contributions based on Republic Act No. 11199 (The Social Security Act of 2018)

4.2

Updating PhilHealth contributions based on Republic Act No. 11223 (Universal Health Care Act)/ PhilHealth Circular 2019-009

Redesign and adding of Dark Theme

4.1

Updating SSS contributions based on Republic Act No. 11199 (The Social Security Act of 2018)

4.0

Updating tax computation based on Republic Act 10963 or TRAIN (Tax Reform for Acceleration and Inclusion)

Updating PhilHealth contribution based on PhilHealth Circular No. 2017-0024

4.1

Updating SSS contributions based on Republic Act No. 11199 (The Social Security Act of 2018)

4.0

Updating tax computation based on Republic Act 10963 or TRAIN (Tax Reform for Acceleration and Inclusion)

Updating PhilHealth contribution based on PhilHealth Circular No. 2017-0024

Removing special rate for RHQ/ROHQ tax as they will be using the default table based on the TRAIN presidential veto

Bug fixes and performance improvements

Updating tax computation based on Republic Act 10963 or TRAIN (Tax Reform for Acceleration and Inclusion)

Updating PhilHealth contribution based on PhilHealth Circular No. 2017-0024

Removing special rate for RHQ/ROHQ tax as they will be using the default table based on the TRAIN presidential veto

Bug fixes and performance improvements

Updating tax computation based on Republic Act 10963 or TRAIN (Tax Reform for Acceleration and Inclusion)Updating PhilHealth contribution based on PhilHealth Circular No. 2017-0024

Updating tax computation based on Republic Act 10963 or TRAIN (Tax Reform for Acceleration and Inclusion)Updating PhilHealth contribution based on PhilHealth Circular No. 2017-0024

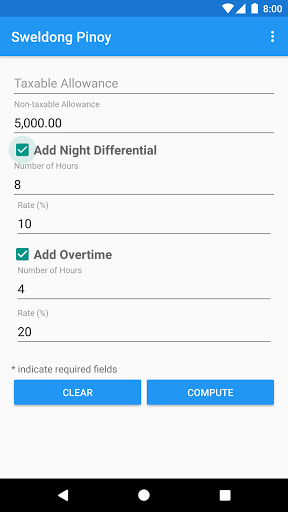

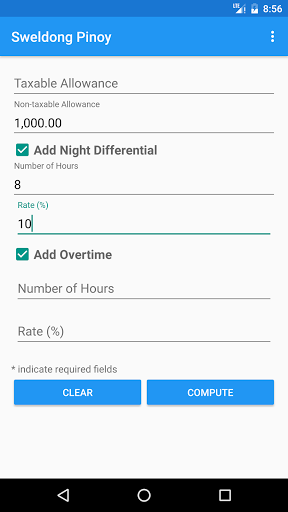

3.1.xUpdating layout for smaller devicesPerformance improvements and bug fixesUpdating some image/icons3.0Redesign of the applicationMoving Share button functionality into the share icon at the top action bar2.5.xSweldong Pinoy For Minimum Wage EarnersFor employees on daily rate, they can input the number of days and the app will compute the gross pay, deductions, and net payComputing night differential based on number of hoursRearranging compute and clear buttons